The COVID-19 Pandemic has had a major impact on the Egyptian Economy and its different revenue streams; the Suez Canal ‘s revenues could be viewed as no exception. The projected effect on the canal since the beginning of the crisis was anticipated to occur as a result of the decline in maritime traffic due to the slowdown in global economy and production. This in fact took place as ports worldwide began seeing lower cargo volumes and freight rates significantly declined as a result of lower demand. However, record low oil prices is weighing down on the situation even more.

Oil prices, market uncertainty and supply gluts, caused by COVID-19 and oil market disruptions are causing oil traders to make some recalculations that could slash one of the Egyptian government’s main sources of foreign currency.

What’s Happening?

The Suez Canal is a lifeline for global seaborne trade as it reduces the sea voyage distance between Europe and India by around 7,000 km, allowing ships to travel between Europe and Asia without navigating the Cape of Good Hope around Africa.

However, oil tankers now, are recalculating whether the fees are worth paying given fuel at historically low prices and the value of cargoes almost certain to rise in the future, in addition to storage options running out.

According to Bloomberg, a supertanker named New Vigorous with 2 million barrels of crude concluded a trip last month from Saudi Arabia to northwest Europe via South Africa’s Cape of Good Hope arriving at the port of Antifer in northern France to become the first in almost two years to make this voyage. This has been followed by several attempts of same nature, and Maersk and MSC announced that they plan to reroute an unspecified number of their container ships from the Suez Canal to the Cape of Good Hope. Such attempts opt for a longer sail around the African continent after low oil prices have made the journey less costly than the Suez Canal’s passage fees.

This happens stemming from a market condition known as contango, which means that near-term prices are lower than those in the longer-term. As a result, tankers are attempting to slow down even though they’re laden with cargo as opposed to normal circumstances when they slow down when they were empty to save money on fuel charges.

This Explains…

Since oil prices plummeted it could be more cost efficient for a trader to avoid the Suez Canal, cutting down hundreds of thousand of dollars even though the trip is longer, as the additional fuel costs are lower than paying tolls to transit the Suez Canal.

Government Response:

The Suez Canal Authority has announced that as of 1 May and until 30 June fees will be reduced for container ships crossing the Suez Canal.

- For container ships originating from the US and heading to destinations in Southeast Asia fees will be reduced 60%-75% for transit.

- Container ships originating from Northwest European ports and the ports of Tangier and Algeria, also heading to Southeast Asian ports, will see a reduction by 17%. The SCA has regularly been offering discounts to vessels passing through the canal in a bid to attract more traffic.

This, however, does not apply on oil tankers. In a statement by Suez Canal Authority spokesman George Safwat to Bloomberg on 7th of May he asserted that there isn’t any change in crude tankers’ fees said Suez Canal Authority spokesman George Safwat and reiterated that once we notice any drop in the number of vessels, the SCA is open to all scenarios.

What to Expect?

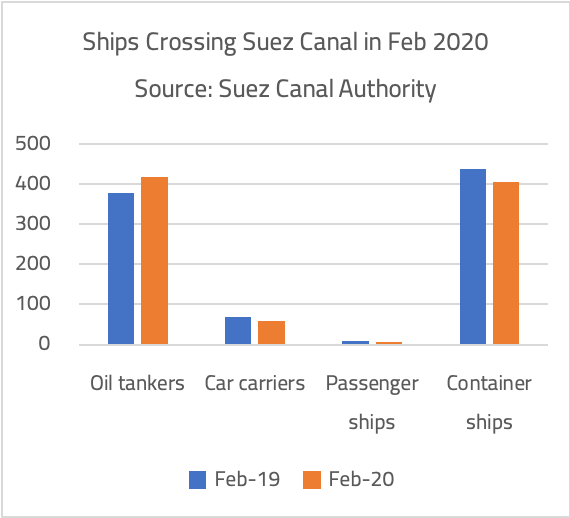

The effect of COVID-19 on Suez Canal is yet to show. The total number of ships that crossed through the canal in February 2020 amounted to 1525 vessels, an increase of 172 vessels compared to the same month last year, but it decreased by about 120 vessels compared to last January.

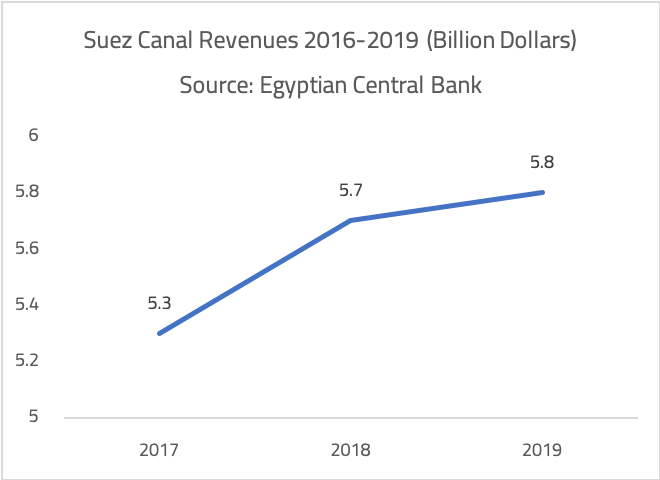

Suez Canal revenues increased to $ 458.2 million in February, compared to $ 433.9 million in the same month last year.

This increase was explained by government officials to be attributed to shipping backlogs from long-term contracts and the agricultural export season.

On the other hand, an overall YoY decline in Canal traffic during February 2020 as container ships transiting the waterway fell by 7.3%, while the number of passenger and cargo ships decreased 22.2% and 1.3%, respectively.

As the backlogs clear and export season ends, and with the re-routing of oil ships away from the Suez Canal, revenues are expected to witness a sharp decrease after 3 years of annual increase starting from March if the pandemic crisis remained. In case of no improvement in production, or a second wave of the virus, Egypt would thus be bracing to see a pressure on the current account, adding to the pressure on exchange rate as well as reserves.