A report from the Russian Central Bank that is now offline has the answer

“War is a matter not so much of arms as of expenditure” those were the words of the ancient Greek historian Thucydides, dubbed the father of political realism. With these words and many others that highlight the relevance of economy to war politics and calculus this article tries to unravel the truth about Russia’s foreign reserves and explore why despite its large amounts the Russian government may not be able to withstand the wide-ranging sanctions imposed against it by the West.

The whole point of Russia’s Central bank stockpile of reserves is to maintain the stability of the Russian Rouble in times of crisis and market volatility. These reserves are composed of the equivalent of $630bn in different currencies (Yuan, Euro, Dollar and Sterling) as well as 2,300 Tons of gold. This is true as of January 2022, according to the Central Bank of Russia (CBR).

A report by the central bank of Russia in early 2022 details these reserves, though this report is no longer available on the CBR’s website it has been captured by the web archive “Wayback Machine”.

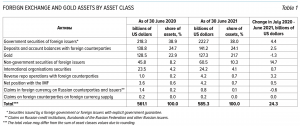

Data in the aforementioned report explains why the latest sanctions imposed by the west are so crippling to the Russian economy by rendering its most of its reserves utterly useless. To understand this better we need to take a look at the composition of Russia’s foreign reserves as outlined in the CBR.

Table 1 describes how securities make up a large portion of the Russian reserves, in particular around $307 billion, almost half. These securities are meant to be relatively liquid to provide quick access to cash when needed to bail out the Rouble. This, unfortunately, is not the case now due to the sanctions imposed on the Russian banks and the barring from the swift system, as well as the Russian central bank. Also, the shows how the (CBR) has about $141 billion (around 25%) in deposits with foreign counterparties, which is held in a number of major currencies as explained in chart 2.

The chart elaborates how a third of Russian foreign reserves are held in Central banks within the Euro system, these have already frozen off all accounts for the (CBR) preventing access to their funds.

Chart 3 points out how China has the largest share of the Russian reserves for any single country, about 14% of total Russian reserves. While it is still unclear how China will act on these reserves, there is strong evidence to suggest that it may offer Russia a means of trading with the outside world either through barter trading or using a Renminbi-based payment system. But with sanctions on Russia affecting high-tech imports and many multi-nationals imposing self-sanctioning policies it is not yet clear how the Russian federation can maintain a strong balance of trade.

The remaining portion of Russia’s reserves are held in gold, man’s favorite precious element offering security and safety in times of need, or does it really? The (CBR) holds the $130.

billion worth of gold that accounts for the 5th largest holding in Russia, safely away from sanctions, however, with the Rouble crashing to it recent low levels it might prove hard for Russia to dispose of its gold in any meaningful quantities that would salvage the economic recovery. Gold has always had it perks as a safety net but to account for the risks of sanctions Russia would have to delve beyond the current gold prices selling at a loss to make any transaction successful.

So, who needs Roubles, with a large portion of Russian citizens looking towards the dollar and foreign currencies for security the (CBR) announced 20% interest rates, effectively doubling the interest rate. Several announcements have been made also to force exporting companies to sell-off their foreign reserves to increase demand for the Rouble. These moves, however, had no major effect as there is no clear economic recovery plan presented by the (CBR).

In its War against Ukraine Russia effectively united the west against it turning this not into a war of Europe, but rather a war between the East and West. In addition, internal opposition is building up as sanctions hit very strongly Russian oligarchs who are close to Putin, forcing them to put even more pressure on the government to halt the war on Ukraine. As it turns out friendship does have its limits. More importantly, while the Russian economy was very strong and projected confidence before the invasion, in a matter of days Russia is looking at a quickly depleting war-chest.

While we stand with Ukraine against the Russian invasion, our hearts also go out to the Russian citizens who are facing worsening economic conditions in light of their governments decision to wolf their neighboring country.